pay indiana state tax warrant

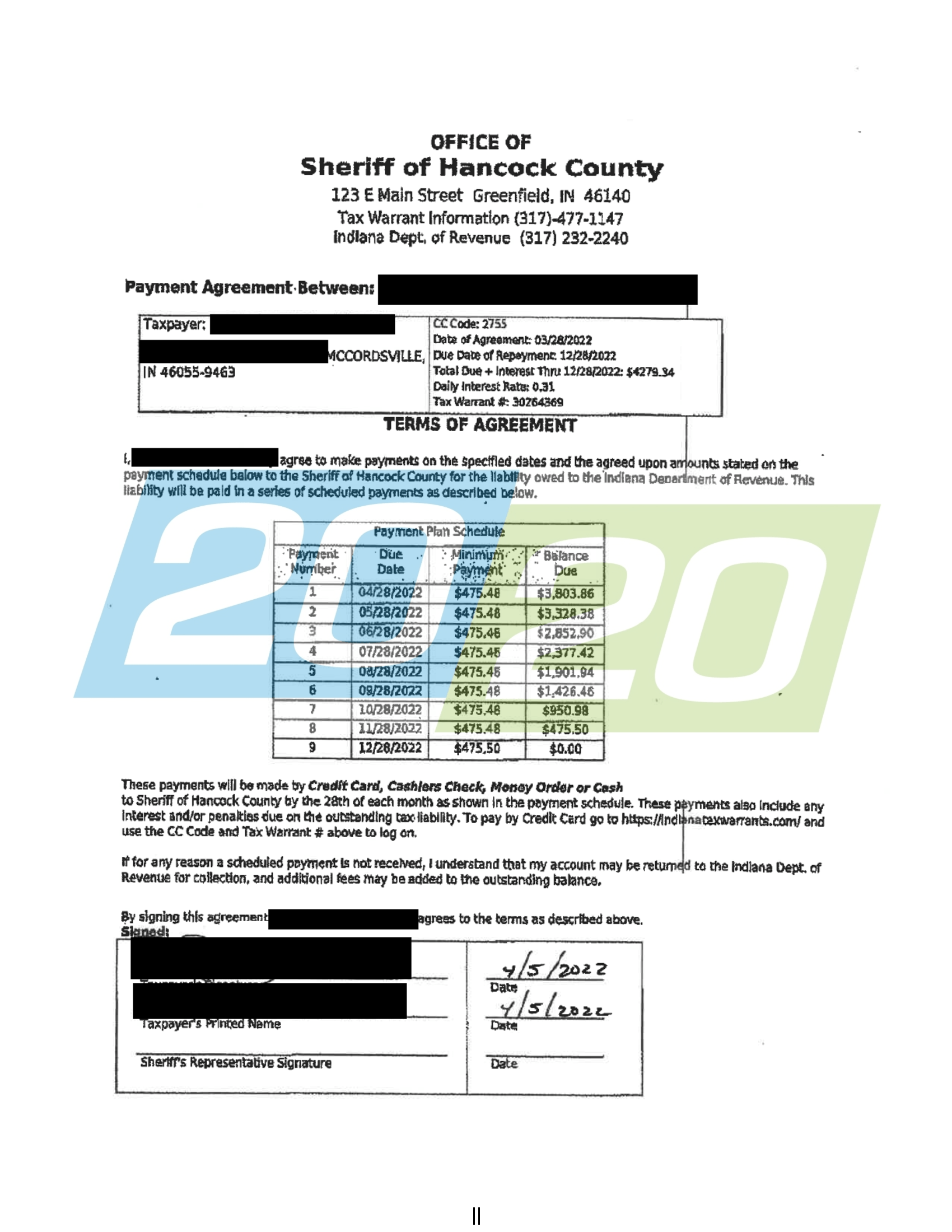

Indiana State Tax Warrant Information. Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxes you must contact them immediately to avoid a court.

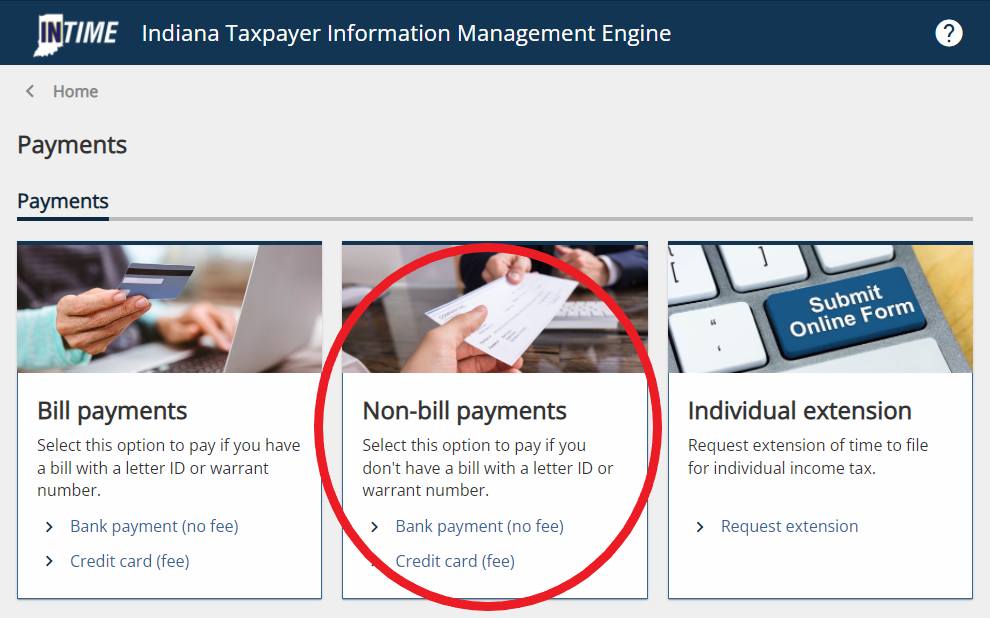

Dor How To Make A Payment For Individual State Taxes

Tax Warrant for Collection of Tax If your.

. Follow A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to. These taxes may be for individual income sales tax withholding. Leave a message with the following information.

Instead this is a chance. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. Warrant payoff letter If you need a warrant payoff letter we can provide you an Outstanding Judgment Balance Due letter which lists all outstanding warrants and the balance.

The sooner you pay your balance the less additional interest and penalties youll have to pay. Make a payment in-person at one of DORs district offices or. Eligible taxpayers may request a tax warrant expungement for tax liabilities that have been resolved through the Indiana Department of Revenue DOR.

Set up a payment plan by calling 317-776-9860. Paying one-half of that notice within the 20-day response period will provide another new notice to pay the balance in full within the 20-day time frame. Be ready to enter your letter ID or tax.

Subscribe or Login to access details and additional features. Welcome to the Indiana Department of Revenue Pay your income tax bill quickly and easily using INTIME DORs e-services portal. You can pay online by visiting.

Your name please spell your name on your message Tax Warrant Number located in the. Pay Taxes Electronically DOR Online Services Pay Taxes Electronically The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e. How do I pay my Indiana state tax lien.

You can make your payments by phone by calling 317-232-2240. Learn How Individual Income Taxes Business Tax Corporate. The turnaround on tax warrants is quick as county courts can approve.

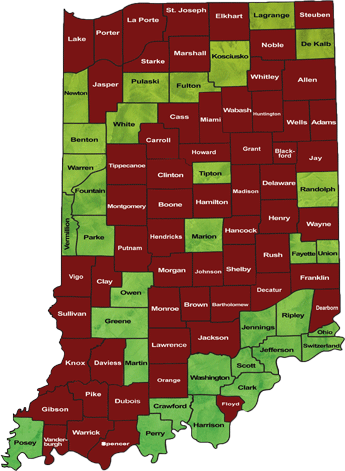

However circuit clerks using the INcite e-Tax Warrant application or. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. Office of Trial Court Technology.

Continue recording tax warrant judgments in the judgment docket if not received electronically see IC. Make a payment in person at one of DORs district offices using cash exact change only personal or cashiers check money order and debitcredit cards fees apply Call DOR. Completed Expungement Request Forms and supporting documentation may be submitted to.

To make an Indiana tax warrant payment online visit the Indiana Taxpayer Information Management Engine IN TIME. Questions regarding your account may be forwarded to DOR at 317-232-2240. A tax warrant issued by the Indiana Department of Revenue will also add 10 percent to the unpaid tax as a collection fee.

Make a payment online with INTIME by credit card or electronic check. About Doxpop Tax Warrants Doxpop provides access to over current and historical tax warrants in Indiana counties.

Dor Indiana Department Of Revenue

Real Tax Resolutions In Indiana 20 20 Tax Resolution

Hoosiers Get Another Month To File Pay 2020 Indiana Taxes Wthr Com

Notary Signing Agent Document Faq General Warranty Deeds Nna

Another Tax Scam Letter Tax Assessment Procedures Domestic Judgment Registry

Florida Dor Tax Resolutions Consequences Of Back Taxes

Taxpayer S Guide To Indiana Dor Tax Warrants

An Overview Of Indiana Tax Problem Resolution Options

Covid 19 Resources Indiana State Bar Association

Indiana Tax Warrants System Atws

Where S My Refund Indiana H R Block

Owing Money To The Indiana Department Of Revenue Dutton Legal Group Llc

Madison County Sheriff S Department

Indiana Tax Warrants System Atws

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Indiana Military And Veterans Benefits The Official Army Benefits Website

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities