amazon flex after taxes

And 3 have set your home city within the Amazon Flex App to any active service area in the United States a Participating Location. 2 2021 at 329 pm.

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

1099 Forms Youll Receive As An Amazon Flex Driver.

. Amazon Flex Reviews Online. While most things you pay for as part of being a self-employed Amazon flex driver are tax write-offs there are some things you may pay for that you cannot deduct against your taxes. Fines and penalties eg.

Lets take a closer look at what this means. This app makes keeping track of my tax deductions a breeze. Stride is a cool and free new option for mileage tracking.

From there it is the individuals responsibility. Like all employers Amazon is required to issue a 1099 to all independent contractors who earned more than 600 through their employment in the previous tax year. No matter what your goal is Amazon Flex helps you get there.

Reserve your favorite delivery blocks with Amazon Rewards. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. Make quicker progress toward your goals by driving and earning with Amazon Flex.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Look into paying estimated taxes because none is being withheld -- or the IRS will get testy with you read. If you made less it doesnt have to be reported.

Also depending on your States laws you will need to pay an annual income tax on the gross amount you earn through Amazon Flex. Amazon Flex drivers are getting back 60 million in withheld tips thanks to FTC settlement. Its gone from a chore to something I look forward to.

You only need to claim flex on your taxes as income if you made over 600 for self employment. Amazon Flex drivers are self-employed. As for payment Amazon Flex drivers are paid twice weekly on Tuesdays and Fridays.

The IRS lets you deduct business mileage on your tax return so you can potentially keep more of your hard-earned money when filing taxes. Youre an independent contractor. Amazon will issue a 1099 to Flex Drivers.

3 2021 at 809 am. You pay 153 SE tax on 9235 of your Net Profit greater than 400. It has 33 stars on average on Indeed.

Most drivers earn 18-25 an hour. The concept for Amazon Flexs reward program is simple. The more deliveries you make the more points you earn.

Or download the Amazon Flex app. HMRC interest and penalties. With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes.

You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. It has 25 stars on average on Glass Door right now. As an independent contractor you will need to account for taxes and file quarterly taxes if needed.

Get started now to reserve blocks in advance or pick them daily based on your schedule. Actual earnings will depend on your location any tips you receive how long it takes you. Amazon Flex is a courier service for you guessed it Amazon.

Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Welcome to the AmazonFlex Community where AmazonFlex Drivers come together. This includes things like.

Amazon Flex quartly tax payments Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. IRS mileage rates vary by year but in 2021 the rate was 056 per business mile. Watching my deductions grow.

Ad We know how valuable your time is. Whether youre saving up for that dream car or simply finding creative ways to make ends meet Amazon Flex could be a great way to earn some extra income. Is Amazon Flex profitable.

With Amazon Flex Rewards you can earn cash back with the Amazon Flex Debit Card enjoy Preferred Scheduling and access thousands of discounts as well as tools to navigate things like insurance and taxes. The negative reviews largely mention things like. With Amazon Flex you work only when you want to.

It offers an automatic system that detects when youre driving so you. Each delivery results in at least one point but as per Amazon You can get points even faster by delivering with quality and reliability. The forms are also sent to the IRS so take note if youve made more than 600 in the relevant tax year.

Our team of tax experts are here to help with anything you may need. Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. 23 days ago.

To participate in the Rewards Program you must 1 meet all eligibility requirements to be a delivery partner under the Flex Terms. Amazon Flex drivers receive 1099-NEC forms from the company according to online reports. Deliveries made for Prime Now or Amazon Restaurants are paid via direct deposit after your tips are processed in 1-2 days after the delivery.

Another reason tracking Amazon Flex gas costs is important is to potentially claim tax deductions. Since its debut in 2015 Amazon Flex has launched in over 50 cities across the United States. They are responsible for paying their taxes at the end the tax year.

But if you made more than that then you probably need to file an amendment so that you dont get in trouble. Training and courses for new skills. Food except in certain circumstances.

Unfortunately not everyone has had a wonderful experience with Amazon Flex and there are a fair amount of negative reviews. 2 have an Amazon Flex account in active standing. Fine you in the spring because youll be under-withheld.

No matter how much you earn as an Amazon Flex driver you are. Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least 600 working for the service within the tax year. All American taxpayers have a constitutional obligation to pay income taxes no matter how high they earn.

![]()

Triplog Automatic Mileage Tracking Made Easy

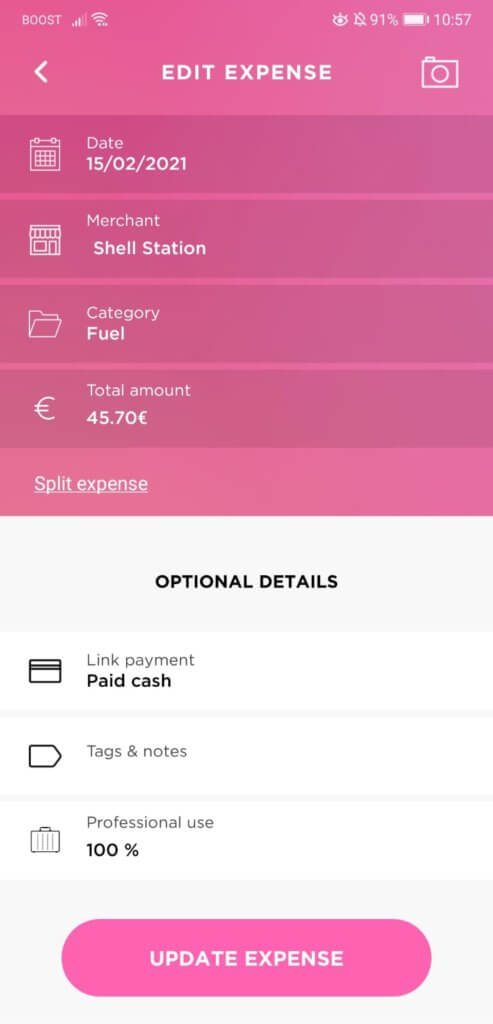

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Amazon Sales Tax A Compliance Guide For Sellers Sellics

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Bic Flex 4 Sensitive Hybrid Men S 4 Blade Disposable Razor Now 3 28 Was 7 99

Shopnomo Nike Men S Ck Racer 2 Running Shoes Nike Men Nike Running Shoes

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Does Amazon Flex Take Out Taxes Find Out Answerbarn

How To Do Taxes For Amazon Flex Youtube

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable